Points and Miles Explained

If you’re a Travel Hacking newbie and need the difference between points and miles explained, welcome! If you’re new to this, I also recommend checking out Frequent Flier Miles 101, were we take a look at the basics of credit cards. In that we look at some of the basics of points and miles. Now we’ll look into what these actual credit card promotions are.

Banks want our money. Obvious. So, they further entice us to sign up for their branded credit cards by offering varying bonuses and promotions. Some of these bonuses are awarded upon the first swipe or purchase, some require a minimum spend within a window of time, others further incentivize you with your daily expenditures, offering extra perks for certain purchases.

The bonuses vary greatly from bank to bank and card to card. And although I’m very knowledgeable with Travel Hacking, I’m not an overall credit card expert. My expertise is directly related to my greatest passion, travel. There are thousands of credit cards, with thousands of different offers and bonuses and promotions, many of which have nothing to do with travel. Some credit cards offer a generous ‘cash back’ promotion, some offer lower interest rates, some offer no interest for the first year… the list goes on and on.

But I’m not a Life Hacker, I’m a Travel Hacker. Although other cards may offer nice perks, I’m not interested in straight cash-back.

My concern revolves exclusively around my ability to pursue my greatest passion; accumulating miles and points, to be able to travel as cheaply as possible.

Credit Cards are the best source. ‘Cash back’ is good. But if you want to travel, points and miles are king.

So, to recap. Credit cards incentivize people to sign up for them by offering extra perks. The perks that interest us most are travel related points and miles.

Points vs Miles

If you are confused, don’t worry, this is all very simple. In essence points and miles are one in the same. They are rewards given back to the cardholder for your spending loyalties.

Some cards and banks issue miles, some cards and banks issue points. You spend a dollar on one credit card, you get a mile. You spend a dollar on another credit card, you get a point. The difference is the value of each point or mile, and that value is determined by the bank, airline, hotel, or their alliance.

Miles

Miles are simple. Miles are a currency, and their value is set by the particular airline issuing the miles. Just as the value of the dollar will differ from country to country, so will the value of the mile differ from airline to airline. United, American, British, Lufthansa; all of the major airlines have a miles program and place a value on those miles.

Miles confused me for a long time. When I first started Travel Hacking, I knew I wanted miles, but I hadn’t the slightest clue of what to do with them.

Simply, miles give you free-ish flights. Airlines establish a set amount of miles you need to book a free flight departing from and landing in a certain destination. It can be any kind of flight, in any kind of class. First Class, Business Class, Economy and anything in between. One way, round trip, domestic, international or around the freaking world, it doesn’t matter. Each flight has a value, and similar to it’s dollar value, it’s mile value will increase in quality of class and quantity of distance.

To clarify.

Quality of Class – A ticket in First Class or Business Class, will cost you more miles than a ticket in Economy. (Check this link out if you’re curious which class I recommend redeeming for).

To further clarify.

Quantity of distance – The further you fly, the more miles it cost. Flying New York to Atlanta is much cheaper, in both cash currency and miles currency, than flying New York to Hong Kong.

So, obviously, a one way Economy flight from Miami to Orlando, will be significantly cheaper, in both cash value and miles value, than a one way flight in First Class from Miami to Berlin. Duh.

Here are some layman’s terms and an accompanying example

The cheapest one way flight based on United Airlines Award Chart from New York (‘Mainland U.S., Canada and Alaska’ zone) to Rio De Janeiro (‘Southern South America’ zone) is an economy seat, which will cost 30,000 miles.

An important note here, is that owning 30,000 miles on United (or any airline) does not mean you have the ability to fly 30,000 miles… although that would be awesome. The 30,000 miles is an accumulation of currency that enables you to purchase flights based on the value of those miles. United says it will cost you 30,000 miles to fly from NYC to Rio in economy. So that is the cost.

Lifehacker breaks it down here, pointing out that “Just because you get 2,734 miles for traveling from Seattle to Miami, for example, doesn’t mean you get another free flight… For example, with Frontier’s reward program, you get a free roundtrip domestic ticket for every 20,000 miles you acquire. That means it’ll take about four roundtrip flights between Miami and Seattle to get enough miles for one free flight.”

So the miles’ value is more like a rewards system.

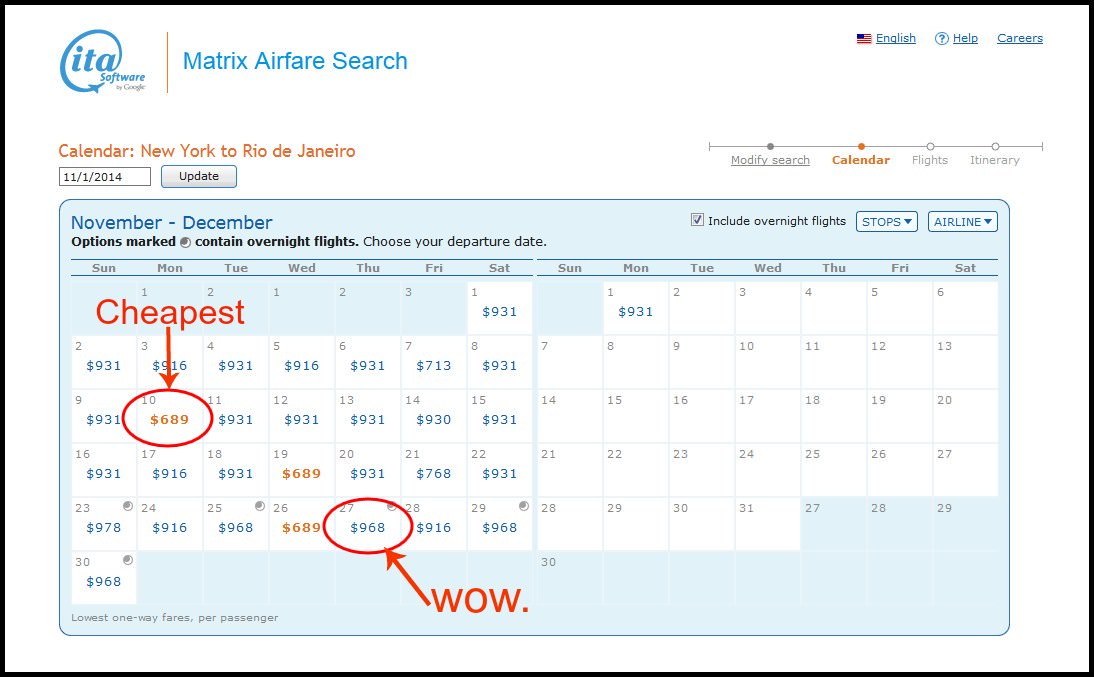

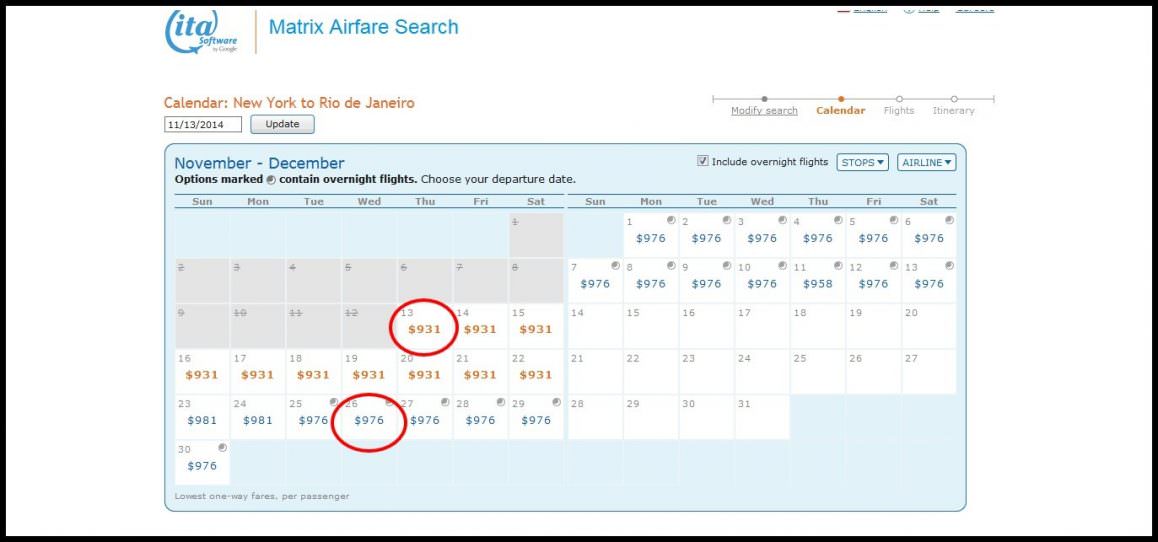

Personally, that confused me for a while. My previous traveling experiences had me conditioned to be familiar with flights possessing a cash value. If we look at the cash value of a flight, it’s dollar value (or Euro or Yen or whatever) can greatly fluctuate. If you are looking to book a one way flight from NYC to Rio, it could be 600$ three months from now, 1000$ three weeks from now, and $2000 three days from now. Let’s look.

Yes. Damn. Flying certain routes can be very expensive. I even took the liberty of looking 3 months ahead. The flight to Rio from NYC is going to cost anywhere from $689 – $968! ONE WAY.

But with miles, it doesn’t matter. As long as the flight is available (something we will deal with much later on) it will cost you 30,000 miles. No if’s and’s or but’s. 30,000 miles and whatever taxes the particular country of arrival charges, it doesn’t matter if it’s booked a year ahead or an hour ahead.

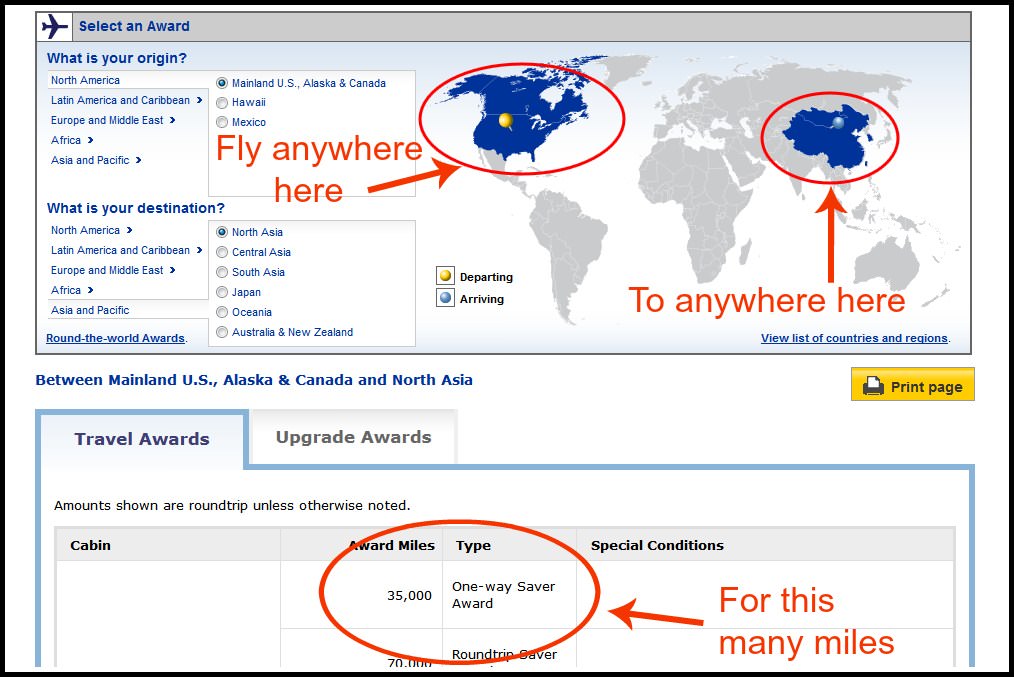

Another cool thing is the zones, if you want to fly on United Airlines, but this time from New York City (North America Zone) to Beijing (North China Zone), it will cost you 35,000 miles.

Above is United.com’s ‘interactive travel destinations award chart.’ It’s basically a search engine for flights on United and their partners when you want to pay with miles. If you choose to fly United, that will extend to all of North America and all of North China. Los Angeles to Shanghai? 35,000 miles. Vancouver to Beijing? 35,000 miles. Miami to Zhangzou? 35,000 miles.

Most airlines will set a consistent mileage price for consistent areas of the world.

So you could see just how valuable miles can be. Their value is constant, and opposed to paying for flights with actual money, their price will not fluctuate with time or demand. Paying cash for our trip from NYC to Rio would be expensive, but by utilizing frequent flier miles we have the ability to save ourselves up to a grand.

So you want to accumulate miles?

Traditionally, the only way to accumulate miles was just from flying. If you flew the same flight from New York to Rio De Janeiro, you would be flying 4,826 miles, and after the flight, you would be awarded with 4,826 miles into your frequent flier account.

Now we have the ability to collect tens of thousands of miles by doing things we would already be doing, by spending money we would already be spending.

Points

Similar to miles, points are a currency. But as opposed to miles, the value of the points’ currency is determined by the banks that are issuing the points. Chase Ultimate Rewards value is determined by Chase bank. Similarly, Barclays Arrival points value is determined by Barclay’s bank.

Now, with miles, they are uni-faceted. You can only use miles for flights. You can’t use your 1,500 American Airlines points to buy a candy bar at Walmart. Flights via American Airlines and their partners – that’s it.

Points differ. Typically the infrastructure of points is more versatile. Chase Ultimate Rewards are arguably the most dominant (and our favorite) points system, and you can use the points for nearly anything.

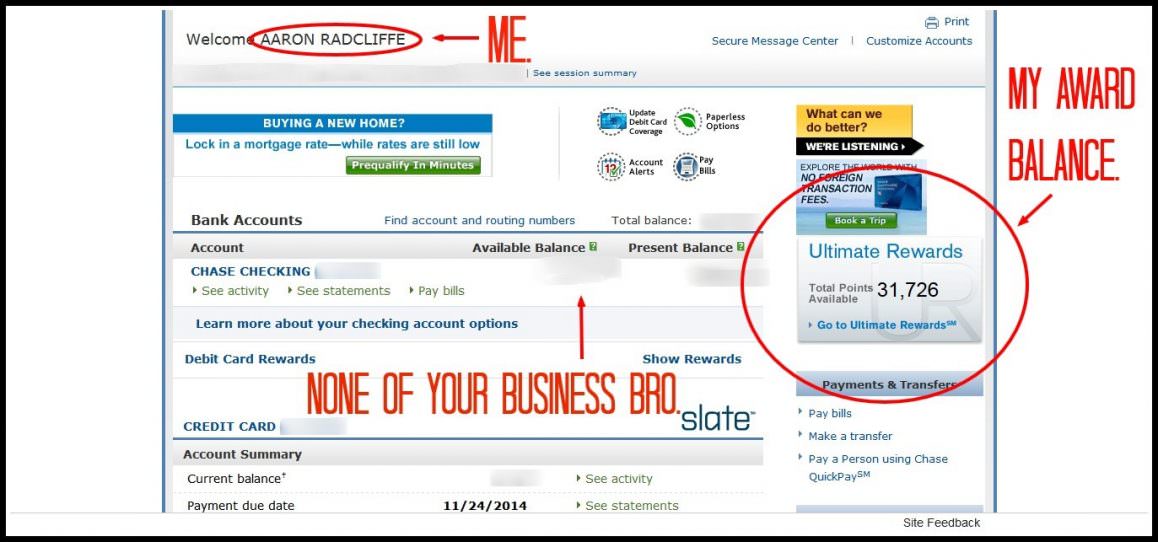

At the time of writing this I had 31,726 Chase Freedom Points, which equals $317.26 cash currency. The math is simple, Chase rewards one point to your rewards balance for every dollar you spend (until I blow your mind later that is) hence, here the value of a point is one cent (remember this for later).

Above is the Ultimate Rewards Mall, a virtual store provided by Chase, where I can redeem points for basically anything, and there’s a lot of stuff. Kitchen appliances, computers, the newest Radiohead album, a blender… It’s a mall. You get the jist. When you make travel purchases through the Ultimate Rewards Mall you do get a fixed rate with your points at 1.25 cents per point. This means if you spend $300 (30,000 points), you get an extra 25% bonus of $75. This is a really nice perk, but I don’t go into it, because we can do much, much better. Don’t worry about the mall for travel purchases, few of us do. The real value comes when we transfer our points… Keep reading!

Points possess a versatility that miles do not. Many banks will allow you to do a variety of things with your points. If you don’t feel like shopping for a new blender, Chase will let you redeem your points for cash, and as stated, each point has the value of a penny. So, if I want, I can redeem my 31,726 points for $317.26 cash. It’s my 31,726 points to do whatever I please with.

But this is where it gets fun.

You can transfer points from the banks (Chase, Barclays) and point programs (Starwood Preferred) to airlines and hotels.

Again, using the example of Chase Ultimate Rewards (above), you can transfer your points from Chase bank to United Airlines, Korean Airlines, British Airways, Southwest and a variety of other partners at a 1:1 ratio.

“What the hell is a 1:1: ratio?”

What this means is that if you have exactly 30,000 Chase Ultimate Rewards points, you can transfer them to United Airlines, and receive exactly 30,000 United Miles. Anything transferred as a 1:1 ratio is good. Anything less is the opposite of good.

Since I actually have just a little over that 30K mark, we’ll use it as an example.

Math time.

If you have earned 30,000 Chase Ultimate Reward points, you can either get the original value of one cent per dollar (30,000 points = 300$) and get cash back or purchase something for $300 (again 30,000 points = $300) at the virtual mall, OR, you can transfer the points to an airline (30,000 points = 30,000 miles).

300$ cash vs 30,000 United miles. Which do you prefer? If you want to travel, you will choose the miles without hesitation.

As we looked at earlier, 30,000 United miles currency can get you a one-way ticket from NYC to Rio in economy class.

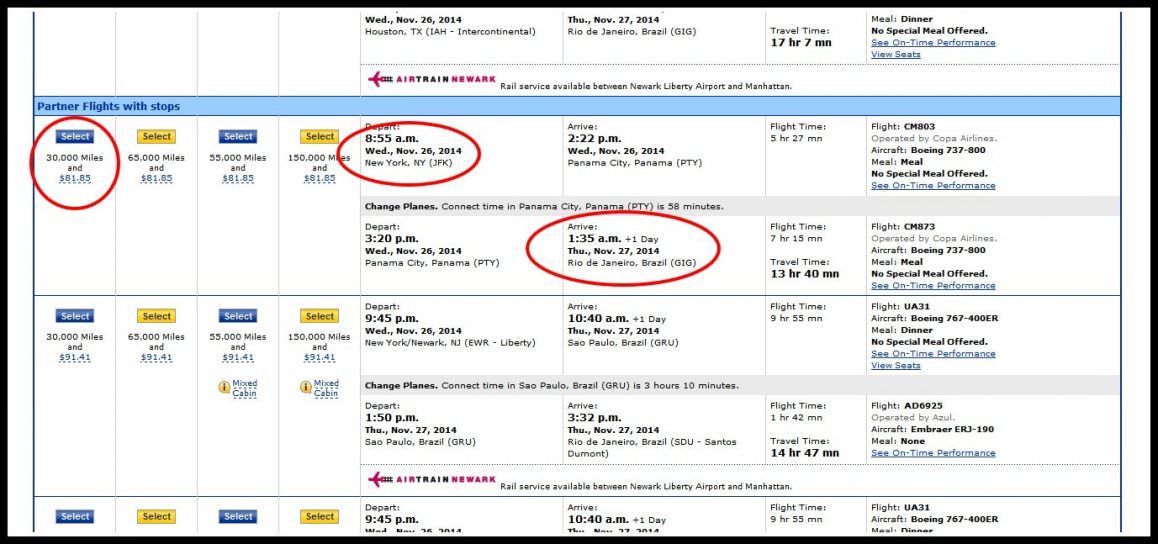

I did a search on United Airline’s Award Travel for flights sometime in the next month, and found a flight, two weeks from the date of search, from NYC to Rio… for only $81.85. Hell yea.

Award flight availability will vary depending on which airline you are booking with and your intended dates of travel, so as a rule of thumb it’s always best to book as far in advance as possible. But, as you can see above, you don’t always have to. Our United miles have enabled us to fly from NYC to Rio, in two weeks time, for only $81.85 in Brazilian Taxes. Truly spectacular.

Now let’s compare what we pay in miles currency to what we would have to pay for in cash currency.

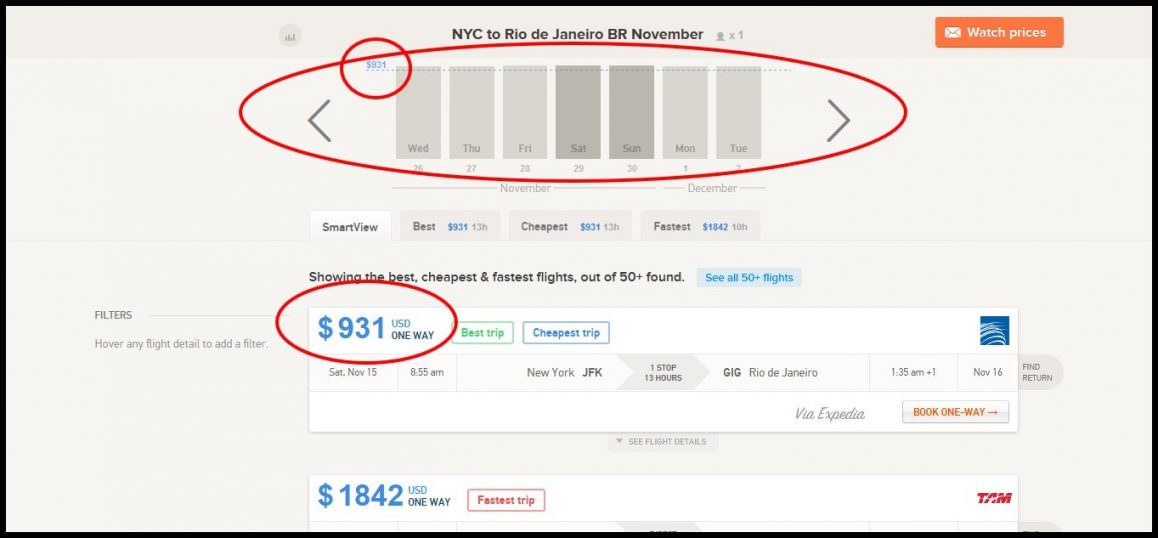

Using Google’s Matrix (one of the best resources to find the cheapest flight possible), the cheapest flight we can find is $931.00… $976.00 if we want to travel on the 26th, the same date the award flight is offered.

Adioso? Same results.

Kayak pulls through a little clutch (highlighting why you always want to check as many search engines as possible), finding us a flight for $831.00.

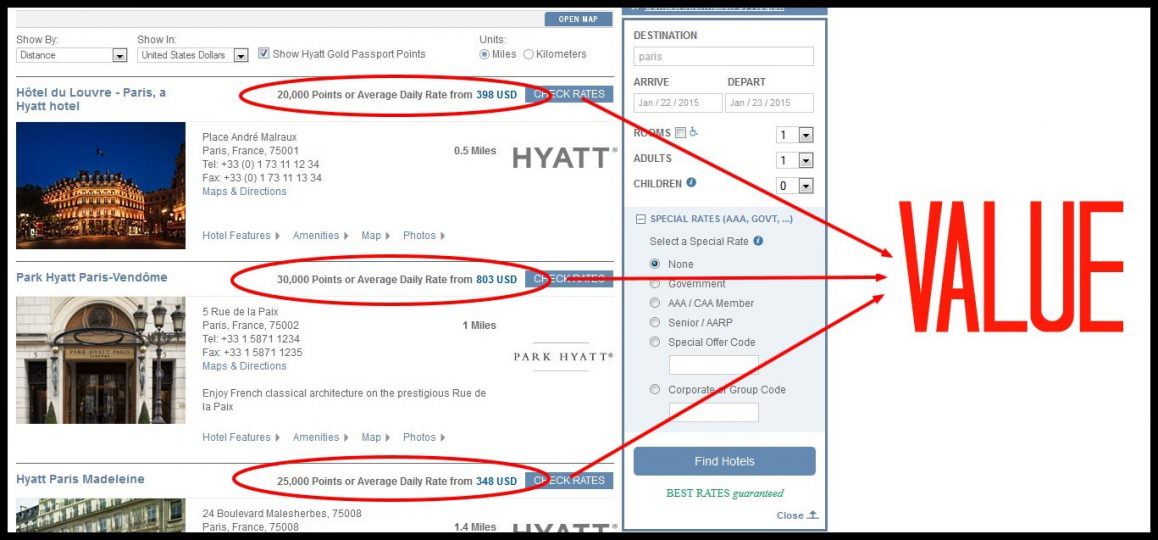

Now, I don’t want to go too far into flights here, I’ve dedicated an entire section to that. Let’s shake things up a bit and consider the versatility we have with our points. Hotels are another incredibly valuable way to use your heard earned points, and similar to flights can provide tremendous value. Just like United Airlines, we can transfer our Chase Ultimate Reward points to hotels at a 1:1 ratio. Let’s consider Hyatt.

For this example, we are traveling to Paris, France and feel like living it up a little bit. Hyatt offers economical and luxurious lodging options around the world, and depending on your personal preference, your points can be used for either. The middle option, Park Hyatt Paris Vendome is“one of the most luxurious 5 star hotels in Paris. [Their] coveted location brings the city to your doorstep, overlooking the fashionable Rue de la Paix and within walking distance of Place Vendôme and Opéra Garnier.”

Sounds super fancy. And it comes at a super fancy price tag, with rooms starting at $803 USD per night. And I was checking in January, the very cold off season. I’m sure prices inflate substantially in the summer months.

But! Why pay $803 when I can transfer over 30,000 Ultimate Rewards? A lot of people prefer to spend their points on luxurious hotels stays, and understandably so. Although I will typically fore go the route of luxury and choose to use my points for free flights, either is a viable option as they both have immense value.

– Cashing in 30,000 Ultimate Rewards points for straight cash = $300 = $.01 value point per dollar

– Transferring 30,000 points to Hyatt for a night in Paris = $803 value = $.026 value points per dollar

– Transferring 30,000 points to United for one way to Brazil = $831 value = $.0277 value point per dollar

Does the extra $.017 not seem like a lot? Not at first glance. But consider the value! Transferring points to airlines and hotels is one of the greatest ways to maximize your credit card rewards, and truly reap some incredible traveling benefits. You can have the ability to triple the value of your bonuses if you redeem them for travel purposes. If you need the $300 cash, by all means, take it! I would if I needed it as well. But if you are trying to travel the world cheaply, and are ready to display the financial responsibility required, miles and points through credit card signups are the single greatest way.

This article is meant to get you to understand these promotions – points and miles explained on the most basic level. With this information, you can build, and travel anywhere for pennies on the dollar.

Dominate your travels.

Anything you liked? Does this help explain points and miles? Comment below!