How to Get Points and Miles for Free Travel

Cutting down the cost

Travel is awesome. That’s why you’re here, right? Because travel is awesome. But it can also be expensive. Particularly flights (unless you read this) and accommodation (unless you read this). But do they have to be…? Enter the world of Travel Hacking, where I will explain to you how to get points and miles for free travel.

The structure of travel related credit card promotions vary, which is super awesome, because it equips you with multiple ways to achieve greater bonuses, which allow you to travel cheaper. Here are the different ways we get points and miles for travel for free…

1) HUGE signup bonuses

The best travel cards are the ones that lure you with an enormous incentive. Typically, these bonuses range anywhere from 5,000 all the way up to 100,000 points or miles. They are either awarded to you upon approval, or after you meet a designated minimum spend.

The cards that give you the bonus upon approval or your first swipe are just awesome. Credit Cards that give rewards upon the first purchase are plentiful and give the Travel Hacker a lot of flexibility. I recently applied for Barclay’s US Airways card, was approved, went to the store,bought a six pack of beer, and was given my bonus of 40,000 US Airways miles.

Annual Fees – A quick side note, that most of these cards will charge an annual fee, usually ranging around $80-$100 a year. A lot of times the bank will waive the annual fee for the first year, and a lot of times they won’t. So the 40,000 points I obtained above with US Airways technically cost me $89 for their annual fee. So, technically, I am paying $89 for 40,000 US Airways points. 40,000 US Airways points can do a lot, like get me a free round trip to Hawaii… I accept. More on annual fees in a bit.

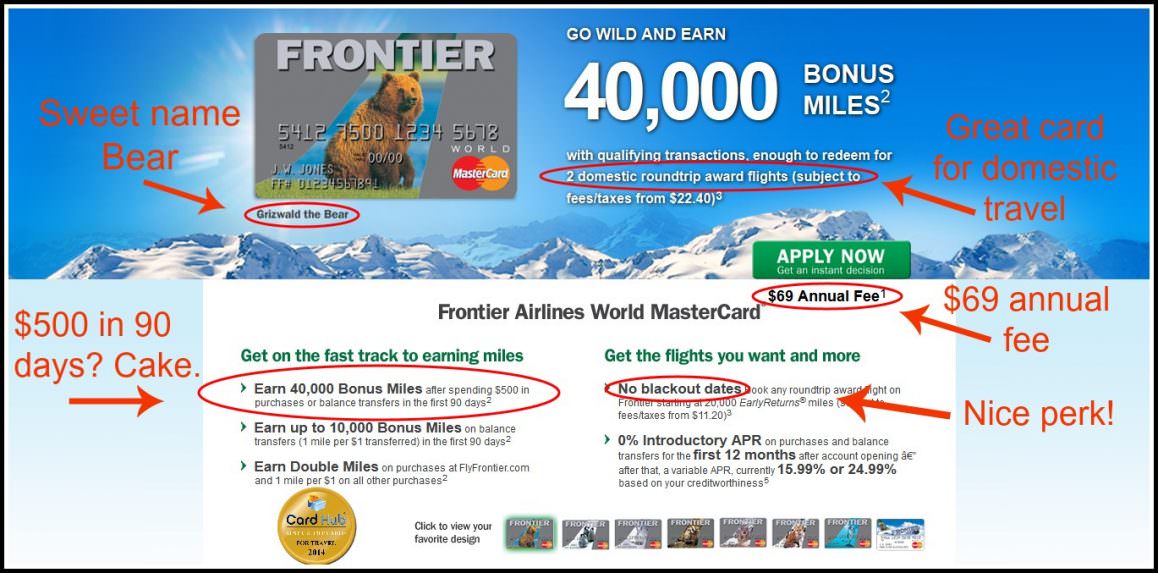

Minimum-spend bonuses can also greatly vary. Some are lower, some are higher. Cards on the lower end, like the Barclay’s Frontier Card, only require a $500 minimum spend within 90 days for their bonus.

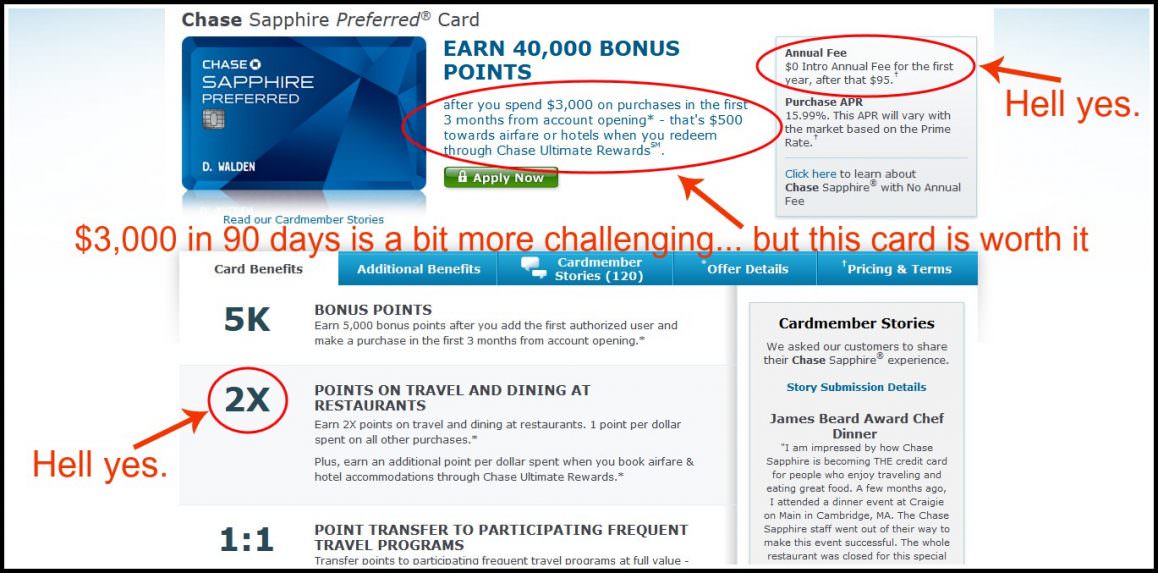

Some of the minimum spend cards can be higher, such as my favorite card, the Chase Sapphire Preferred, which required me to spend $3000 within 90 days to receive my bonus.

With each of these examples Barclay’s US Airways, Barclay’s Frontier, and Chase Sapphire preferred, I was rewarded 40,000 miles or points. That’s not the total of the three cards - that’s per card. I was rewarded with 40,000 Frontier Airline miles, 40,000 US Airways miles, and 40,000 extremely valuable Chase Ultimate rewards points. That’s 120,000 miles and points for spending $3,500 in 90 days (plus $158 in annual fees) on things I was already spending money on.

We went over how valuable 40,000 miles was. Imagine the travel possibilities with 120,000 miles.

There are lots of different cards with lots of different offers. Here are some examples of some other travel credit card sign up bonuses (as of July 2014). Notice the differences in minimum spends. Some are as low as $500, and others will go way north of that.

Chase British Airways Credit Card

50,000 British Avios Points after spending $2,000 in 90 days

$95 annual fee

Citi Platinum Select/ AAdvantage World Master Card

50,000 American Airline miles after spending $3,000 in 90 days

$95 fee waived the first year

Chase Ink Bold Business Card

50,000 Chase Ultimate Reward points after spending $5,000 in 90 days.

$95 fee waived the first year

Chase United Mileage Plus Explorer

30,000 United miles after spending $1,000 in 90 days

$95 fee waived the first year

Barclaycard Arrival World MasterCard

40,000 miles after spending $3,000 in 90 days

Some cards will even offer a double whammy, awarding you with a certain amount of miles/points upon your first purchase, then enticing you to spend more with another bonus down the line…

Starwood Preferred Guest from American Express

10,000 points upon first purchase, and another 15,000 points if you spend $5,000 in six months

$65 fee waived the first year

US Bank Club Carlson Premier Visa

Earn 50,000 points with your first purchase, and an additional 35,000 points after spending $2,500 in the first 90 days

$75 annual fee

As opposed to points or miles, some cards will simply offer you something free

Chase Hyatt Credit Card

Spend $1,000 in three months, and receive two free stays at any Hyatt in the world

$75 annual fee

Chase British Airways Credit Card

50,000 British Avios Points after spending $2,000 in 90 days

$95 annual fee

Citi Platinum Select/ AAdvantage World Master Card

50,000 American Airline miles after spending $3,000 in 90 days

$95 fee waived the first year

My personal perspective is this. If you are going to be spending the money anyways, why not get something back for it?

$3,500 in 90 days is a breeze for most people. Internet, electricity, water, groceries, bars, restaurants, insurance! These are all monthly expenditures for us, all of which can be paid on a credit card. Assuming I have the cash to pay my credit card bill, I will pay for NOTHINGwith cash now. I was going to spend the $3,500 in 90 days regardless. Credit Card Travel Hacking enabled me to get some bang back for my buck through these sign up bonuses. A lot of bang for my buck.

2) Points for Everyday Spending

So. It’s been 90 days, you’ve spent the money you normally would have spent, but this time on a credit card. Each month since you started spending on your card you’ve paid it off in FULL, and now you are looking at all of your bonus points, thinking about which exotic countries you are going to visit, and overall, feeling pretty swell.

But what do you do with your credit cards? This is where accumulating points for everyday purchases adds another dimension to the game.

Every single one of these cards, will give you a minimum of one point for every dollar you spend. You met the minimum spend on your cards? Don’t put them away! Continue to use them! Don’t get crazy and spend money you don’t have to get points, that’s absolute stupidity. But if you have the money for something you were going to buy anyways, charge it to the card!

Look at it this way, if you have to pay a $24 tab at your favorite pub, you can pay for it with cash, and receive nothing in return, or you can pay with your travel credit card, and get 24 points in return. Are 24 points a lot? Not really. But does it add up over time? Oh yes. Although most of my points have come through sign up bonuses, I have obtained over 50,000 points and miles from everyday spending.

But wait. You might be going the math, and calculating that I had to spend $50,000 to get 50,000 points or miles.

Wrongo. Like I said, most cards will reward you with a minimum of one point for one dollar spent. So yes, if you use the aforementioned Barclay’s US Airways card for the same $24 tab at your favorite pub, 24 miles will be directly deposited into your US Airways Frequent Flier Account. Cool? Yes. Can you do better? Absolutely.

Each and every travel credit card has it’s own particular promotion. Some will offer extra points in certain categories, some will come with a discounted flying companion pass, some will offer lounge access at the airport. Yet again, the list goes on and on, it just depends on the particular card. What we are focusing on here, is spending categories.

Let’s say you were at the same pub, racked up the same tab, but paid it with a different card, the Chase Sapphire Preferred. The Preferred is a legend in the Independent Travel Industry, one of the countless reasons being it always returns 2 points for every dollar spent on dining. Whether you are in the mood for Moroccan or Mexican, Maker’s Mark or Michelob, a bar, a restaurant, hole in the wall or fine dining and everything in between… the Sapphire Preferred does not discriminate. It will give you 2 points for every dollar, in every restaurant or bar, across the entire planet. It’s too cool.

Even further.

The Chase Freedom has rotating quarterly categories that reward you 5 points for every dollar spent. FIVE. And although some of the quarterly rotating categories might be slightly more obscure (Kohl’s and Lowe’s this year) some are broader categories like gas stations and restaurants. So, for three months out of the year, you have the ability to get five points dining anywhere in the world. And if you have an Ultimate Rewards account, you can transfer the Cahse Freedom Points to the your Chase Ultimate rewards account.

Let’s recap the different options for paying our $24 bill at our favorite pub.

If you use cash, you get nothing in return.

US Airways Card? 24 miles.

My baby, the Sapphire Preferred? 48 points.

The Freedom (if within the rotating quarters?) 120 points!

So would you rather use cash and get nothing, or use a card and get something back for what you are spending? Mathematically it seems obvious that 120 is greater than 0.

You can do this with everything. The Freedoms offers 5 points for every dollar spent at gas stations for two quarters of the year, meaning for six months of the year, I am getting 5 points for every dollar I spend on gas. There is a spending cap of $1,500 per category, but who cares! Even if you spend $1,000 on gas and restaurants with a quick stop at Kohl’s for some fresh new clothes, you are retrieving 5,000 points for money you were spending anyway.

So, while signup bonuses are far and away the most lucrative means of how to get points and miles for free travel, everyday spending is just as important and can add up very quickly.

Tying it All Together

Let’s say we take it easy and just want to apply for a few Chase cards, one at a time, four months apart from each other. Let’s say the Sapphire Preferred, the Ink Bold and the Freedom. These cards enable you to stock up on Chase Ultimate Rewards, which are the king of travel points and my highest recommendation.

-

Chase Ink Bold

50,000 bonus points after spending $5,000 in 90 days

-

Chase Sapphire Preferred

40,000 bonus points after spending $3,000 in 90 days

-

Chase Freedom

20,000 bonus points after spending $500 in 90 days.

So let’s say we meet these minimum spends throughout the year, it gives us a total of 115,350 Ultimate Reward points.

50,000 + 40,000 + 20,000 + 8,500 spent = 115,350 points

We now have our bonuses. Let’s look out daily expenditures.These are the averages for annual American expenses.

These numbers are taken from multiple surveys, including the Bureau of Economic Analysis, the CITA Wireless Association, and the NDP group.

Food: $6,129 or 9.81%. That’s $2,505 eating out and $3,624 eating at home.

Housing: $16,557 For those who have a mortgage, $3,351 goes just to the interest and other charges. For people who rent, $2,900 is spent on their home.

Clothes and related items: $1,700 is spent on clothing, shoes and other related items.

Transportation: $7,677 gets allocated to being mobile. This includes the car payment and upkeep, public transportation, and even the occasional water taxi. Gas and motor oil account for $2,132 of this cost.

Health care: $3,157 pays for doctors’ visits, colds, broken bones, and other healthcare related expenses.

Entertainment: US Consumers use $2,504 of their average income to be entertained, whether at the movies, concerts, or other venues.

Personal Insurance and pensions: $5,373 is paid into personal insurance policies or pensions.

For the sake of this hypothetical example, let’s low-ball these numbers, and cut most everything in half.

- Food – $3,064 total, $1,812 on groceries and $1,252 at restaurants.

This past year, the Chase Freedom offered 5 points for every dollar on restaurants for three months of the year. Outside of that, the Sapphire always offers 2 points for every dollar in restaurants. Roughly, you would get 1,500 points for the three months the Freedom was good, then an additional 1,878 points from the Sapphire. Unfortunately there are no extra perks for groceries with any of these card, but we’ll take 1 point per dollar

Restaurants = 3,387 points spent. Groceries = 1,812 points

- Living – $1,450 if you pay rent or $8,000 if you have a mortgage.

Although there are ways to pay rent with a credit card, I don’t personally think it’s worth whatever charge it costs to do so. Now if you have a mortgage, there are multiple options for paying with a credit card, and obviously the value of an extra 8,000 – 16,000 points a year speaks for itself. But considering that a lot of us won’t be dealing with either, I’m excluding the category altogether.

Rent = 0 points

- Clothes – $850

I’m going to be honest, I don’t think I’ve spent this much on clothes in my entire life (half kidding), but the average is the average I guess. If you utilize some online shopping portals and take advantage of the Kohl’s 5 points per dollar, you could definitely squeeze out more than 1 point per dollar in this category. Again though, I’ll low ball it and call it at 1,000.

Clothing = 1,000 points

- Gas – $1,066

If you have a car and are spending gas money, the Freedom will allow you to get 5 points per dollar for half the year at gas stations. I love the Freedom.

Gas = 3,456 points

- Transport – $2,500

No extra points here or anywhere else.

Transport = 2,500 points

- Health – $3,157

No health industry perks… yet

Health = 1,578 points

- Entertainment – $1,252

Aside 5 points at movie theaters, there aren’t many extras here

Entertainment = 1,400 points

- Cell phone bill – $852

I didn’t chop this one in half because it seemed pretty spot on, averaging at $71 a month. The Chase Ink Bold returns 5 points for every dollar spent on your cell phone bill.

Cell = 4,260 points

- Landline/Cable/Internet – $1476

I kept this one as-is as well. Yet again, the generous Ink Bold will reward 5 points for every dollar spent on cable and internet year round.

Cable/Internet = 7,380 points

Add it all up.

24,917 points spent + 115,350 bonus points = 142,123 Ultimate Reward Points for money you were going to spend anyway!

If you could fly to Rio for 30,000 points, imagine what sort of traveling you can do with 140,000 points. The hardest part will be deciding just what to do with them all.

So, what are we seeing here? The most important thing is that the most dramatic means of accumulating points and miles is through sign up bonuses. No question. But, if we continue to utilize these cards and strategize our spending habits, we can also greatly profit from our every day bills and expenditures and get points and miles for free travel

And also take into consideration, these numbers were very, very conservative. The average person spends much more than this, and if they get more cards, utilize portals and research other nifty ways to maximize their cards. This also represented a single individual… imagine how much a family could save.

And although my example was about someone living a ‘normal’ life, if you are already a perpetual traveler, you can still greatly benefit from these cards. I do. The Chase Sapphire offers 2 points on anything travel related. Anything travel related. I accumulate a lot of free travel, while paying for traveling. It’s really a thing of beauty, and I encourage you to personally reap the benefits.

I’m not trying to convince you to obsess over points. I’m not a hard core coupon-er. I don’t pinch a penny every time I can. These examples are merely here to show you what is available, and hopefully inspire you to up your travel game.

Also, if you’ve made it this far, you probably want to know more, so check out the Frequent Flier Miles 101… you’ll like it.