How Travel Hacking Improves your Credit Score

If you are reading this article, it’s most likely because you’re interested in Travel Hacking.

Perhaps you’ve heard the catchy name in passing. Could’ve met someone who claims to have flown to another country for less than $10. Or maybe you saw a post on a travel blog. Then maybe you saw another post on another travel blog.

So you start researching a bit. See what Google has to offer. (That’s when the mind gets blown).

You’re confused. You’re excited. You want to travel, but the greatest hindrance to traveling is the cost. So the possibility of being able to lower the cost of traveling by getting free(ish) flights and accommodation is too much to handle.

You want to jump right into it. But something seems off. How is this possible? This dude claims to have eight credit cards? His finances must be f**ked!

Well I need to tell you something. I’m a Travel Hacker. But I don’t have eight credit cards.

I have fifteen credit cards.

I've used these credit cards to accumulate over 600,000 points and miles, saving me approximately $10,000 on flights and lodging over the past few years.

I apply for cards, travel freely, and most importantly, sit back and watch as my finances improve.

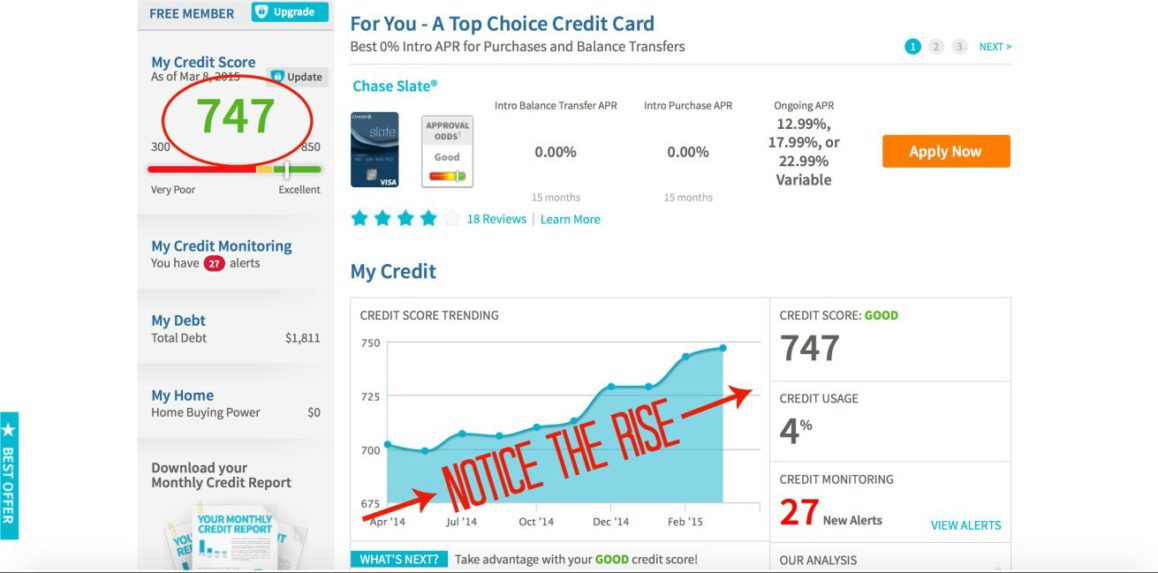

This was my credit score last year.

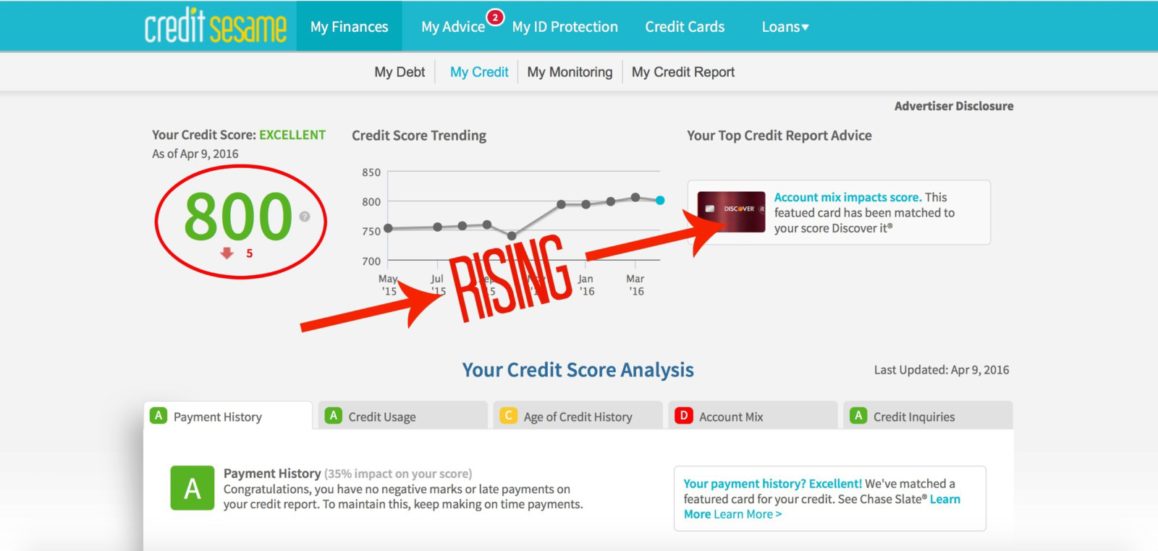

And this is my credit score a few months ago.

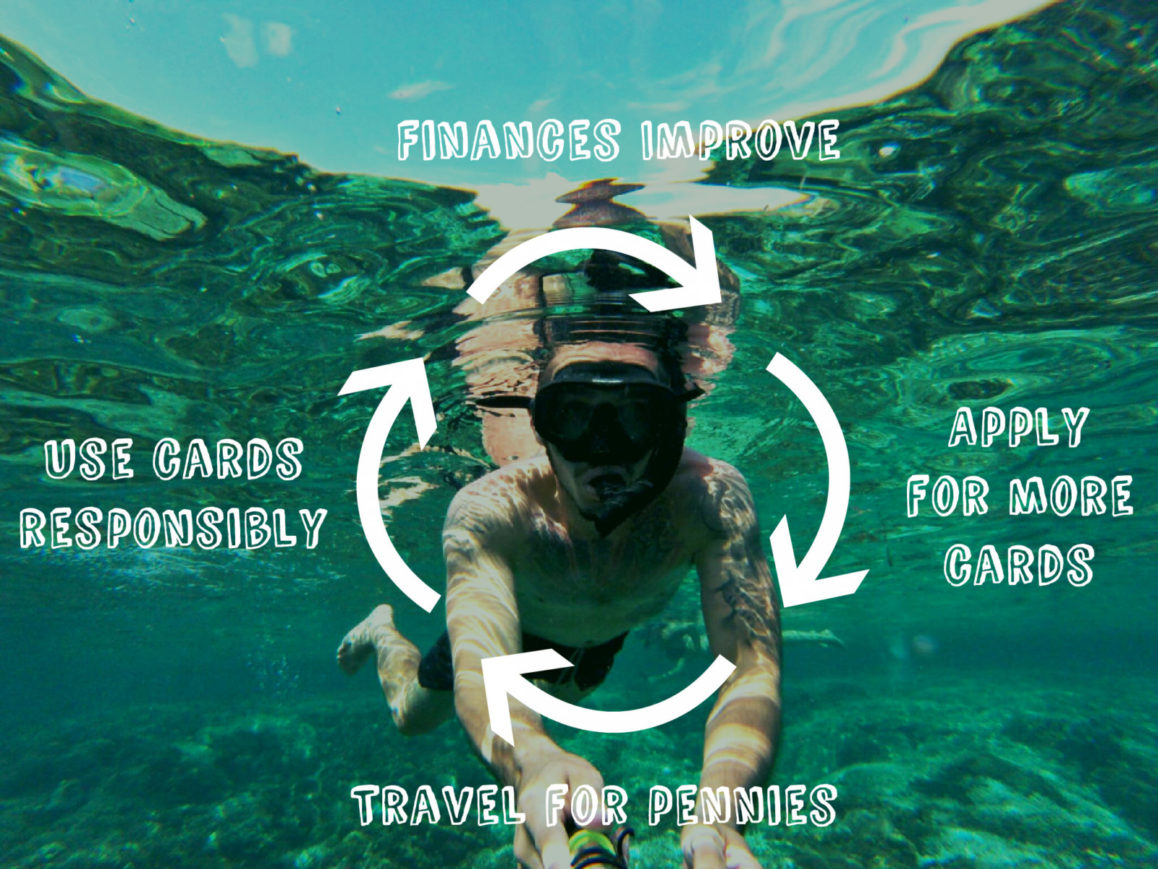

How is it possible that Travel Hacking improves your Credit Score? Let me introduce you to a little something I’ve dubbed “The Circle of Points”.

The Circle of Points (Cue Elton John)

The “Circle of Points” is how all of this is possible. It’s what enables us Hackers to do what we do. It makes our Hacking world go round. From the outside, it might seem like we are living on the edge, engaged in some kind of financial-Russian-roulette. Spinning the chamber, waiting for the inevitable bang.

In fact – it’s the complete opposite. Much more boring.

Travel Hackers are a bunch of nerds. We learn about finances, master our credit scores, and strategically apply for a s**t ton of credit cards that enable us to travel for pennies on the dollar.

Like when I flew from Fort Myers to Paris for $5.60.

Or that other time I flew from Tokyo, Japan to Lima, Peru last minute, for $59.63.

I know.

It doesn’t make any sense right now. It didn’t make sense to me either. When I began, I could accept that there were ways to travel cheaply with points and miles. And I could accept the ways to improve your credit scores. But I couldn’t accept that both were simultaneously achievable.

They are. And by the time you are finished reading this article, it will all make sense.

Let’s start from the beginning.

What is Travel Hacking?

If you are new to Travel Hacking, read this. Then come back.

Credit Card Travel Hacking

Ok, you get it. People are Travel Hacking.

They’re applying for credit cards, spending money on those cards, getting bonuses, using those bonuses to travel for pennies on the dollar, are applying for more credit cards, and repeating the cycle.

This makes sense to most.

But what doesn’t make sense is…

How is it possible to continually open new credit cards, without decimating your credit score?

We’ve been lead to believe that credit cards should be kept tame, and at an arm’s length. We’ve been lead to believe that opening multiple cards (especially at the rate Travel Hackers do) will annihilate your credit score.

But it just. Isn’t. True.

Travel Hacking improves your Credit Score (while scoring you free flights and hotels). To understand this, we must first understand the ever-entertaining topic of personal finance.

(The crowd roars.)

I know. It’s lame. But there’s no way around it. Travel Hacking takes knowledge and discipline. If you want to accumulate hundreds of thousands of points and miles to travel the world for free(ish), you need to understand personal finance.

Personal finance is the reason “The Circle of Points” works. Personal finance is the foundation on which you will build your Travel Hacking Empire.

Knowledge and discipline with my personal finances are the reasons I have fifteen credit cards, travel the world at will, while still having the credit score I displayed above. It takes proper planning, positioning and preparing, but it’s all very doable.

Credit Score

To those of you questioning ‘how the F is it possible to open fifteen credit cards in three years and still have an excellent credit score?’. I retort with this. ‘Are you aware of what constitutes one’s credit score?’

(Silence)

Few do people know. My parents don’t. My friends don’t. In fact, I’ve met very few people that do!

And when you think about it, it’s surprising! Personal finance directly impacts our lives. Our Credit Score dictates the loans we get, and the interest rates we get them at! Car loans, credit cards, mortgages, layaway, whatever! Travel Hacking is no exception.

If you want a great credit score, you have to follow a set of established rules. Travel Hackers follow these rules, and in the process earn hundreds of thousands of points and miles to travel the world for pennies on the dollar.

Factors That Influence Credit Score

1) Payment History (35% of credit score)

Out of the four categories combine to create our Credit Scores, payment history is the most important. It is as it sounds. Have you paid your bills on time?

Because you need to.

A single 30 day delinquent payment can drop your credit score by 100 points! And that single 30 day delinquent payment can stay on your credit score for up to seven years!!!

BOOM. Like that. Years of hard work erased because you didn’t make a minimum payment.

I can’t stress enough – do not miss a payment.

Payment history is divided into two different categories.

1) Bank Owned Debts

These are bank-run accounts, and therefore are heavily monitored. This includes, but is not limited to…

- Credit Cards

- Retail Credit Accounts

- Installment Loans

- Finance Company Accounts

- Mortgage Loan

There is very little room for error with these types of accounts. If any payment is late by 30 days of the due date, it will be reported to the credit bureaus and immediately impact on your score.

Good News

- You should always try and pay your balance in full. But if you can’t, a minimum payment will suffice.

- Late payments less than 30 days are not reported to the credit bureaus. This is HUGE. We are all human beings – capable of mistakes. I’m totally guilty, having forgotten my bill date multiple times.

If you miss a payment by a few days, it’s not the end of the world. Your bank will absolutely charge you a late fee. But the $25-ish penalty is a drop in the bucket compared to credit-bureau-notification.

Nomad Tip – If you DO miss a payment and are charged a penalty. Call your bank, and ask for the penalty to be waived! It sounds too good to be true, but 50% of the time they will waive the fee for your first (and maybe even second) delinquency. I’ve missed a handful of payment dates on various cards, and have been issued penalty fees. But I called, asked for mercy, and they’ve all been waived!

2) Non-Bank Owned Debts

If you break your arm and go to the St. Mary’s Hospital, your debt is with St. Mary’s Hospital. If you haven’t paid your Verizon phone bill, your debt is with Verizon. So on and so on. This category includes….

- Medical Bills

- Gas Bills

- Water Bills

- Internet Bills

- Buffalo Bills (Joking – just seeing if you’re paying attention)

- Basically any kind of unpaid bills

These are different than bank-owned accounts. When these companies are owed money, the process is a bit slower.

Let’s use Comcast as an example. If you forget to pay your Comcast bill – they’ll cut off your service, probably charge you a fee, and try and collect the owed payment. They’ll write. They’ll call. But what happens if you don’t pay?

At first, nothing. Then if the delinquent payment has not been resolved after 180 days, Comcast will take the debt as a loss, and sell it to a debt collection company at a fraction of the price (an average of four cents to the dollar).

Here’s the important bit. As long as Comcast is trying to get you to pay them (aka usually within 180 days) – the credit bureaus will not be notified.

But once they sell your debt to a collection agency – the credit bureaus are notified immediately.

And once the bureau is notified, it will be on your credit report for a long, long time.

Payment History Conclusion

Payment history is crucial. Don’t take it lightly. Whether you have 30 days or 180 days, try and pay what you owe. If you don’t it will haunt you.

2) Credit Utilization (30% of credit score)

Coming in at a close second is Credit Utilization, which dictates 30% of your score. Credit Utilization can be summarized as your ratio of debt-to-available-credit.

For example, let’s say you have three credit cards.

Credit Card One has a $9,000 limit.

Credit Card Two has a $9,000 limit.

Credit Card Three has a $2,000 limit.

Your total available credit would be $20,000.

The best utilization rates are the lowest utilization rates. The goal is to be near 0%.

If you have to carry a balance? Try and keep it under 10%, but never let it go over 30%.

This means if you have the aforementioned $20,000 credit limit, don’t EVER carry a balance of over $6,000 (30%). And if you can, try and get that balance to be less than $2,000 (10%).

Sneaky Buggers

Credit Card Utilization rate is not just based on the utilization of the sum of your credit cards, but can also be based on the sum of EACH credit card.

Again, using the above example, let’s say you have three credit cards.

Credit Card One has a $9,000 limit with no current balance.

Credit Card Two has a $9,000 limit with no current balance.

Credit Card Three has a $2,000 limit with a $1,000 balance.

This means you have $20,000 of available credit, but are only using 5% of it (the $1,000 on Credit Card Three).

You think the credit-gods would shine upon this utilization percentage?

Wrongo.

While you are only using 5% of your TOTAL available credit, you are using 50% of your available credit on Credit Card Three.

And the bureaus no-likey this, and it will negatively affect your score.

Keep your debt as low as possible. If you must carry a balance, make sure it’s on a card with a higher limit.

Breathing Room

At a combined 65%, Payment History and Credit Utilization are the two biggest factors determining your score… but utilization is slightly less daunting.

When you miss a payment, it negatively affects your score for seven years. A missed payment from 2015 is still a missed payment from 2015.

In contrast, credit utilization isn’t permanent, and you have the ability to quickly influence your score. By paying off debt and lowering your utilization, you will see a quick and positive impact on your score. While having a higher utilization might have some negative long term impact, it mostly is a reflection of your current ratio.

Conclusion

Keep your debts lowww.

3) Length of Credit History (15%)

Most people believe the longer you have established credit, the better your score. But it’s not that cut and dry. Nerdwallet cites the many factors of this category…

- The age of a consumer’s oldest credit account.

- The age of a consumer’s newest credit account.

- The average age of all of the consumer’s credit accounts.

- How long different types of credit accounts (mortgages, credit cards, auto loans, etc.) have been established.

- How long it’s been since different types of credit accounts have been used.

See? It’s a bit more complicated. But the good news is that this particular category isn’t as daunting as the others.

Notice the drop off? Punctual payments (35%) and Utilization (30%) combine to create 65% of your credit total score! Length of Credit History is only 15%, and it’s considered a more lenient category.

Yes, having established credit is preferable. But being new to credit won’t damage your score too much.

4) New Credit (10%)

This category is somewhat of a conundrum.

Pros and Cons

In the short term – opening new lines of credit immediately damages and benefits and your credit score.

It immediately damages your score because new credit is approved after a hard pull on your credit score, which hurts your credit score by a few points. And new credit cards lower the average age of all of your credit accounts

But it immediately benefits your score by changing your Credit Utilization Ratio (Point #2). If you had a $5,000 total limit and are approved for a new card with a $5,000 limit, you’ve just doubled your available credit to $10,000!

5) Types of Credit (10%)

The bureaus like to see a healthy mix of credit. A healthy mix of credit demonstrates that a borrower can handle different types of credit.

Ideally, you would have been approved for varying types of loans. Student loans. Credit Cards. Mortgages. Etc. The more diversity you show in your borrowing, the better your mark in this category.

But

It doesn’t affect your score much. The last thing you should do is get a car loan for the sake of improving this category.

Credit Score Conclusion

While there is a bit of mysterious-black-magic-voodoo that goes into the algorithm of a credit score – most of it is spelled out. The major points are universally agreed upon, enabling you to take your finances into your own hands.

Heed my advice, and focus on these four parts. It’s all laid out, in plain English, and if you follow these established rules, Travel Hacking will improve your Credit Score as well.

The Pursuit of (im)Perfection

Let’s get something out of the way.

You have to accept that as long as you are Hacking, you will never, ever, have a perfect credit score.

Ever.

As demonstrated in “The Circle of Points”, Travel Hacking is a cyclical process. The best way to earn points and miles is to apply for new cards to get large signup bonuses. But applying for new cards dents your score. While not a significant dent, they ensure that your credit score will never be flawless.

And you know how I feel about that?

No problemo.

If you have a perfect 850 FICO Credit Score – Bravo! It is an impressive feat to say the least. But it doesn’t really mean all that much.

Any credit score over 720 is considered excellent – and excellent is the highest mark one can achieve. An excellent score and a perfect score carry the exact same terms. After 720, Lenders don’t care. 790. 810. 765. 842. Doesn’t matter. Same s**t.

Short Term Detriments

In the short term, approval for new forms of credit lowers your score. Not by too much. But it immediately has a negative impact. There are three reasons in particular.

- Your average credit age is lowered (Category #3 – Length of Credit History – 15% of score)

- A hard credit pull is required (Category #4 – New Credit – 10% of score)

- More credit cards = One dimensional in types of credit (Category #5 – Types of Credit – 10% of score)

Out of the five factors that determine your score, you are negatively impacting the bottom three, which combine to make up 35% of your total score.

But an important note needs to be made here. These detriments do not give you a failing grade in each category, it just gives you a less-great grade. A new inquiry doesn’t give you a 0% out of possible 10% in category #4. Similarly, a new credit card doesn’t give you 0% out of 15% in category #3.

I’d be lying if I said I knew exactly how much it affected your score, but it’s not too much.

Long Term Benefits

As annoying as the short term detriments are, the long term benefits significantly outweigh them.

- Spending and paying off the balance (Category #1 – Payment History – 35% of score)

- Debt to credit ratio improves (Category #2 – Credit Utilization – 30% of score)

Payment History and Credit Utilization combine to create 65% of your total score. Assuming you are using your new card responsibly (paying off balance, not maxing out the card, etc), your credit score is going to see a slow, but very assured rise.

And that guaranteed rise in your score is why the long term benefits significantly outweigh the short term detriments.

Tying it Together

Many Travel Hackers will apply for dozens of cards a year, and with every approval, they reignite the short term detriments over and over.

But it doesn’t matter.

Because they are paying their bills, keeping their debt low, and seeing their scores benefit in the grand scheme. It’s a one-step-back-three-steps-forward kinda thing.

Travel Hacking certainly keeps us from obtaining perfection. But as stated earlier, perfection means nothing to the credit bureaus. The points that are deduced are minor dents. I you are responsible with your cards, and focus on getting a handle on your finances, those dents are short lived and will eventually come around to benefit you.

Remember my credit score? I’m proof.

The Circle of Points (Round Two)

Back to the “Circle of Points”. Does it make more sense now as you look at it? It’s a marvelous system, and it rewards those who are willing to learn and play within the rules. It’s the gift that just keeps on giving!!!

Conclusion

The ‘Circle of Points’ is how I’ve accumulated 600,000 + points and still have an excellent credit score. I don’t reinvent the wheel. I follow the basics of finance.

Travel Hacking improves your Credit Score. Travel Hackers who see their credit scores decrease, do so because they don’t follow the basics of finance.

It’s all laid out there. Plain English. Don’t bite off more than you can chew. Keep debts as close to non-existent as possible, and pay your bills on time.

The rewards are astounding.

Also, if you are interested in learning more about Travel Hacking, download my free eBook where I show my evolution from Hacking Newbie to Hacking Ninja! I show you, step by step, exactly what cards I have, when and how I applied for them, and everywhere I’ve been with the points and miles I’ve accumulated (so far…)

Nice article. One should really pay attention

Any credit score over 720 is considered excellent and excellent is the highest mark one can achieve. An excellent score and a perfect score carry the exact same terms. So you can aim for 720 and live the life you want!