Travel Hacking: Amex Premier Gold

Signup Bonus

25,000 Amex Membership Rewards after spending $2,000 in 90 days

Annual Fee

$195 (waived first year)

[thrive_2step id=’10567′]Free PDF version of this article[/thrive_2step]

Minimum Credit Score

750+

Specs

- 3x for flight purchases when booked directly through airline

- 2x purchase in restaurants, gas stations, and supermarkets (only within USA)

- 1x everything else

- Transfer 1:1 to most hotel and airline partners (Air Canada, Air France, JetBlue, British Air, amongst many others)

- $100 annual airline fee credit

- No foreign transaction fees

- Inflation of ego

A Quick Word

Travel Hacking with the Amex Premier Gold can be sweet. The pros out number the cons in every category… bar one. The $195 annual fee. That aside, this card is one of the top earners on the market, and should be a serious consideration for anyone who seriously travels.

Quick note – this is not a credit card. This is a charge card. Meaning you must pay off the balance in full at the end of every month. Do not carry debt on this card.

The Good

1) 25,000 Premier Rewards

25,000 points is a decent signup bonus – but heed my words. Unless you absolutely NEED this card, I would wait (more on this in “The Bad” section).

These points are very valuable. Similar to Citi ThankYou points and Chase Ultimate Rewards, this card gives you the ability to redeem for travel via the bank’s portal, or transfer your miles to a variety of airlines at a 1:1 ratio.

Travel redeemed through Amex’s portal is gets you .01 redemption. Redeeming 50,000 Amex points gets you a $500 flight. 20,000 gets you a $200 flight. Etc, etc. Not as good as Ultimate Rewards Portal, but it’s an acceptable redemption. While the convenience is nice, if you are looking for ultimate value, there are better options…

2) Some Great Transfer Partners

While there are a plethora of transfer partners available Amex…

They aren’t overly enviable. And not all of them transfer 1:1.

Singapore Airlines Kris/Flyer has some great options, as does ANA.

Remember – when you redeem miles with airlines, you also get to redeem miles with any of their partners, and their partners, partners, and their partners partners partners.

If you transfer your points to Aeroplan…

You get the option to book through any of the airlines in their alliance. Most notably United. I understand that United is an awful airline, with laughably outdated aircrafts and food so bad you’re waiting for Ashton Kutcher to come out and say “You’ve been punk’d!” … But their reward flight availability is one of the best, and they fly to a ton of international destinations. They’ll get you there… Just not in style.

If style is your thing, then the best way to maximize the value of these miles is to Fly Business or First Class, mostly with Singapore or LAN. (If interested, UpgradedPoints has a killer post I won’t even try to compete with.)

At this point in time, Business/First Class isn’t my thing. I prefer to transfer points to to Economy.

Regardless of your preference, you must create an account with the individual airline (pretty easy) and then sync your airline’s account with the Amex site (easy too, but tedious). According to onemileatatime, most transfers are instantaneous, and the few others will occur sometime between 2-5 days.

3) First Annual Fee Waived

The annual fee comes in at a whopping $195 – so it being waived the first year is a huge selling point for the card. Were the annual fee not waived, Travel Hacking with Amex Premier Gold would not be as highly recommended.

4) 3x Points Flights

Again, you’ll only get 3x if you book the flight directly through the airline. No Priceline. No Adioso. No flight search engines. While this can be a headache, it’s not overly difficult. Find the flight on your favorite search engine, then book it direct.

5) 2x Points Restaurants, Gas, Food

Only in the US which is a bit lame. But if you live in the US, and spend correctly, this can add up veryyy quickly.

6) $100 Airline Credit

In theory, this credit is only applicable to unexpected airline fees. Most notably – baggage fees and flight change fees. It’s a good backup to have in case something does happen, and if you are a road warrior, it’s bound to.

If you are able to take advantage of the $100 annual credit for airline fees, it would negate the $195 fee to $95, which is much more reasonable. All of the best travel cards carry a fee around the $100 mark, and utilizing the airline credit fee would basically ensure you were getting the same value out of the Premier Gold that you would say, the Sapphire Preferred, Citi ThankYou, or Barclay Arrival.

7) No Foreign Transaction Fees

Thank you.

8) Special Offers

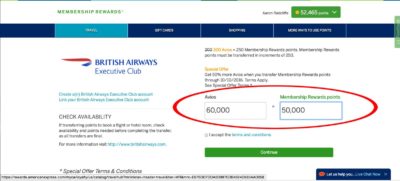

Amex regularly runs promotions with their airline transfer partners. For example, as of writing, they were in cahoots with British Airways (notice the “offer”)…

Upon further investigation…

The bonus offers an additional 50% bonus when transferring miles to BA through October 2016! And because of alliances, you get have the option of booking flights with any of their partners, including LAN (who runs South America) and American Airlines.

If you’re wondering why the math seems off, it’s because Amex transfers to BA at a 4:5 ratio. So you’re getting 50% extra, on a 4:5 ratio (more on this in ‘The Bad’ section). Math. It’s confusing.

Just know that Amex offers promotions, like this, and they can be good.

9) Inflation of Ego

Amex has a reputation. It’s a nice looking card.

The Bad

1) 25,000 Signup Bonus

While the current signup bonus is 25k for $2,000 in spending, this card has a reputation for what I like to call ‘random-outbursts-of-signup-bonus-awesomeness’. What do I mean?

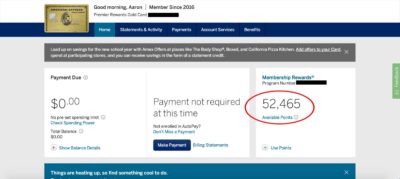

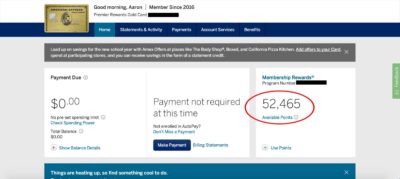

As of writing, I have a bit over 52,000 Amex Premier Points. This is because I waited until Amex upped their signup bonus from 25,000 to 50,000 points. My patience enabled me to double up.

My advice to you? Be patient! Unless you desperately need this card, I recommend keeping an eye out, and when the signup bonus goes to… say… 40-50,000 points… JUMP! Because…

2) One Signup Bonus

Amex, in all of their exclusiveness, only allows one signup bonus, per card, per person, per lifetime.

This is not per usual.

While other credit cards can make it difficult to get a second or third signup bonus, only Amex blacklists you after one. Make the best of it with 40-50,000 points. Cuz once you get a bonus, it’s gone.

3) Annual Fee

Anyone can Travel Hack with the Amex Premier Gold, but the high annual fee discourages people from keeping it. At nearly $200 a year the annual fee is a monster. Not a fun anniversary-celebration.

As said before, if you can take advantage of the $100 airline credit, it’s definitely worth it. You’ll basically cut the annual fee in half.

But taking advantage of the $100 airline credit isn’t as easy as it may seem. Most people will never have to deal with a change flight fee, and if you are a backpacker or independent traveler – you probably won’t have to deal with baggage fees (aka checked bags).

This is the biggest reason I recommend keeping the card a bit more if you are a business road warrior, and a bit less if you are a Nomad.

4) British Airways Devaluation

Amex used to allow members to transfer miles to British Airways at 1:1. Now? 4:5. Ruined it. Still good for the current promotion offer, but once that’s done, hell no.

5) Excellent Credit

This is obviously a bad thing if you don’t have excellent credit. Amex takes their sterling reputation very sterling-ly, and are stingy with their cards. If you don’t have great credit, an application is more like a hailmary (but there’s always time to improve that credit score!).

Strategy

If you live in the US, and are a serious traveler who prefers redeeming in First or Business…. There is a strong case to be made about this being your primary credit card. If you spend a lot of money directly purchasing flights through airlines, the 3x earning on this card can be incredibly lucrative. Add in a few 2x categories (restaurants, gas, groceries) and for the right person, this can be an everyday spender that will rack up a lot of points.

If you have the right credit, I highly recommend waiting for a higher signup bonus (it’ll come), and then apply. You can test the card out for a year. Toy with the airline credit, do some spending, see how you like Amex-life.

If you think the $195 fee is worth it – more power to you!

Otherwise, for the Nomad Travel Hacker – it might be best to get your points, transfer them to your airline of choice, and be done with it.

Conclusion

Travel Hacking with Amex Premier Gold can be awesome, but it’s awesome-ness comes at a price. It’s got some great value (especially in Business and First Class), great earning potential, and gives you an extra unadvertised dose of pompous-ness every time you use it.

But at $195, the annual is a big chunk of change. Since it’s waved the first year, we definitely say go for the card. But give the second year some serious consideration.