Citi ThankYou Premier Credit Card Review (2023)

A Quick Word

I’ve been Sapphire Preferred guy for years now. It’s my primary go-to-card. People have tried to lure me to switching my primary card (most notably to the cult classic Amex SPG and Barclay Arrival Plus) but unsuccessfully.

But in my research for this Citi ThankYou Premier Credit Card Review, I became very impressed with Citi’s ThankYou Premier. Very impressed. Lots of top Travel Hacking blogs were recommending the card. I was so impressed that I even briefly considering ditching my CSP for the CTYP.

I didn’t end up switching, but the impression remained, and lead me to believe Travel Hacking with Citi ThankYou Premier is a must. I was going to give this guy a top-5 spot on my Power Rankings.

Then – Citi pulled the signup bonus.

Gone.

I already have the card and the 50k bonus, so while my internal debate over my primary card might continue… what won’t continue is me recommending this card (for now).

Signup Bonus

None (It pains me, more below)

Annual Fee

$95 (waived first year)

[thrive_2step id=’10610′]Free PDF of this Article[/thrive_2step]

Minimum Credit Score

680+

Specs

- 3x points for any travel related purchases, gas included

- 2x points dining out and entertainment, 1x points everything else

- Ability to redeem travel at 1 : 1.25 (50,000 points = $625) and cash at 1 : 1 (50,000 points = $500)

- Twelve airline and hotel transfer partners, highlighted by Virgin Atlantic, Flying Blue (Air France), and Star Alliance via EVA

- No foreign transaction fees

The Good

1) 3x Travel Expenses

First off, let’s chat about it’s earning potential. 3x on travel, which includes airlines, hotels, hostels, car rental, taxis, cruise lines, and a shlew of other things.

The category is wide open – the only things not covered in the “travel” category are purchases “made at recreational camps, insurance companies, auto clubs, fuel used for non-automobile purposes, and real estate agencies”

This gives the card a comforting layer of convenience. For instance, unlike the Amex Premier Gold, you don’t have to book airline tickets directly through the airline. Any airline purchase. Any hotel purchase. Any site. Three points.

But the most interesting item on the list? Gasoline!

Citi includes gas stations in their broad definition of ‘travel categories’, and earning 3x every time you fill the tank can really add up. If you spend a lot of time driving, it’s definitely worth considering.

3x on every travel related purchase is currently unprecedented. This is more than the Sapphire, more than SPG, and more than the Arrival Plus. Meditate on that for a moment…

2) 2x Dining and Entertainment

You think this card is generous now? In 2015/early 2016, Citi offered 3x’s for all things travel and 3x’s for dining and entertainment. Unfortunately, dining and entertainment have since been downgraded to 2x.

While it would be nice for every category to be 3x (hell, why not 30x?) it’s hard to complain too much, as 2x dining is still great by competitor standards.

With 3x travel and 2x dining, you can see how lucrative the ThankYou can be. But the points are only as good as their value…

3) Great Transfer Partners

Due to the plethora of transfer partners, and large webs of airline alliances, you can transfer ThankYou points to basically any major airline in the world.

I transferred my points directly to Flying Blue (the underrated Air France) for a one way Economy (my preferred way to travel) from Istanbul, Turkey to Hong Kong. 40,000 points and $96. The process was fairly simple, the points posted in a few days – no complaints.

The process will vary. Each airline has their own system and process – some quick and easy, some tedious and annoying. You’ll have to do some research, but preparation is the name of the game…

4) Citi Portal 25% Bonus for Travel

I have mixed feelings about Citi’s Travel Portal. On the positive side, it’s very convenient and very easy to use. You navigate flights (or hotels) on their search engine, choose the one you prefer, book it. Bada-bing!

Plus, when you do book through the portal, Citi hooks it up with an extra 25% bonus.

10,000 points = $125 in travel.

40,000 points = $500 in travel.

Convenience. Awesome. 25% bonus. Awesome.

5) Annual Fee Waived

Huge.

6) No Foreign Transaction Fees

Standard for this type of card. But always appreciated, thank you.

The Bad

1) No Signup Bonus

I hate using all capital letters, but this is an exception, so I repeat again.

DO NOT APPLY FOR THIS CARD UNTIL THE SIGNUP BONUS RETURNS.

While it’s peculiar for Citi to pull the bonus, it’s not without precedent. Lucky from OneMileAtATime thinks Citi likely hit a threshold, and will re-introduce the signup bonus when things calm down later down the line. That is when you attack.

2) Citi’s Travel Portal

In “The Good” section I mentioned Citi’s Travel Portal – highlighted by it’s ease of use and a 25% travel-redemption-bonus.

But the Portal has a dark side as well.

If you’re a more experienced Travel Hacker, it’s not the most efficient flight search engine. I toyed around with the portal for a few hours… and it ended up annoying the s**t out of me.

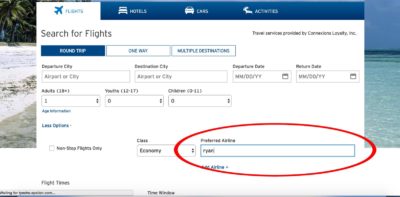

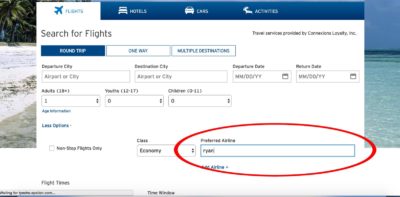

First reason it annoyed the s**t out of me – there are no options for flexibility. No “+3/-3 days” no “my dates are flexible” no “calendar of lowest fare”. Nothing. Which is pretty shocking. Even the more archaic flight search engines have adapted options for flexibility in their software. It’s become standard in the industry.

Apparently not for Citi.

Flexibility is the most important tool in the pursuit for cheap flights. If your search engine does not accommodate flexibility, it will cost you.

Second reason it annoyed the s**t out of me – it misses flights, and a fair amount of them.

It seemed to do OK with long haul international international hauls, but shorter routes, not so much.

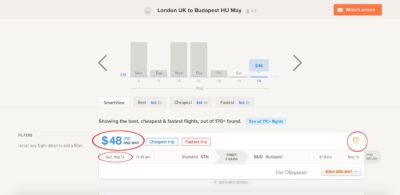

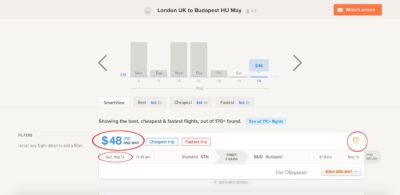

I found this flight via Adioso. Ryan Air. London to Budapest. May 14th. $48. I know, RyanAir is one the worst airlines in the history of mankind, but it’s cheap and sometimes you gotta suck it up.

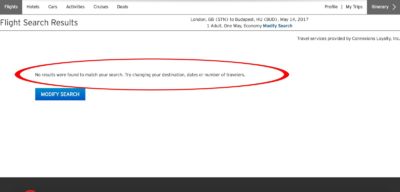

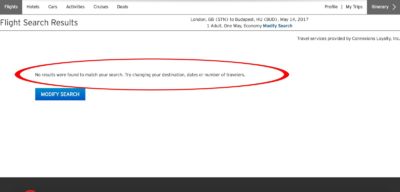

I pull my Citi account, and search for the same flight.

Nothing.

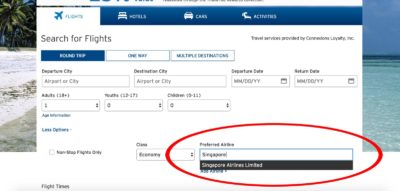

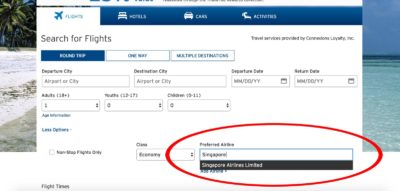

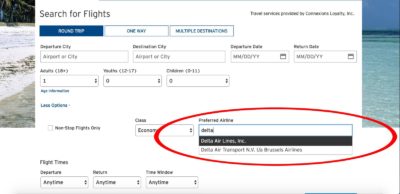

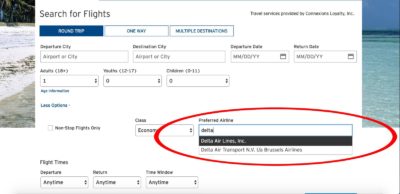

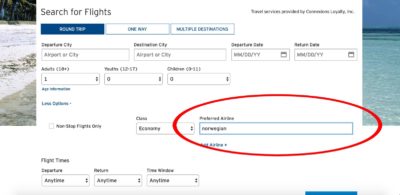

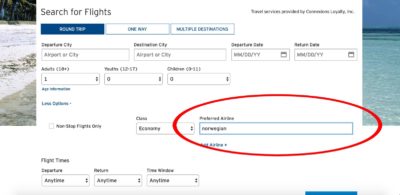

This is because Citi’s travel portal only recognizes certain airlines. You can see which ones they recognize by using their ‘preferred airline’ option when searching for flights.

Singapore Airlines. Recognized.

RyanAir. Nothing.

Delta. Recognized.

Norwegian Airlines. Nothing. (Which is appalling, because Norwegian is one of the best airlines in the world.)

Upon further investigation, the Travel Portal picked up on every major airlines, but only about 50% of the budget airlines.

This is a problem. We are Nomads. Budget travel is kindof our thing.

Lesson? If booking with Citi’s Travel Portal, make double and triple check on other flight search engines to make sure you aren’t missing out on a better fare.

Strategy

Most importantly – wait for the signup bonus to return. If the signup bonus is substantial (40k+), and the perks remain, there’s a great case to make this your primary card.

Conclusion

This card is fantastic and has very little downside to it. Once the signup bonus returns, Travel Hacking with Citi ThankYou Premier will be highly recommended, and the card will return to it’s rightful throne – in the top five of my Power Rankings.